Types Of Life Insurance

Mostly, individuals nowadays like to buy a life insurance policy. Different types of Life insurance policies are appreciated by everybody in current time. People purchase life insurance policy since it secures the family monetarily. The insurance holder can pay the insurance installment from month to month, quarterly or every year. You can pay a premium for policy as long as policy goes on.

Life insurance implies the insurance holder purchase the insurance and in case the individual dies in accident beneficiaries will derive advantage of it and gain a large sum of money. Each person needs to secure his family monetarily with this goal, they purchase a life insurance policy.

Life insurance policy has numerous advantages. If somebody passes on, then with the assistance of life insurance policy his family will be able to pay mortgages, burial costs, debt, and any other types of income lost.

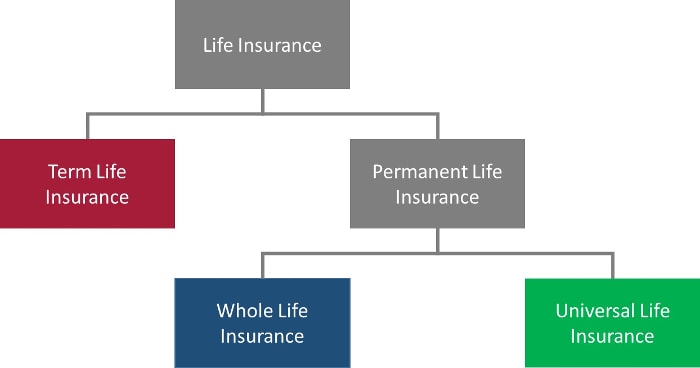

There are diverse kinds of life coverage approaches accessible in the market; you should purchase just that, which suits your requirements.

Sorts of Insurance Policies:

- Whole Life Insurance

- Term Life Insurance

- Indexed Universal Life Insurance

- Variable Life Insurance

Before purchasing any insurance policy, it is essential for people to get learning that what is correct length of policy and to what extent period you need to pay a premium of the policy. There are numerous components that decide the premium of the policy, for example, sex, age, occupation, tallness, weight, medicinal history, and lifestyle.

Whole Life Insurance Policy:

Whole Life Insurance is relatively the same as the life insurance policy. This policy premium goes on for somebody whole life. Upon death, the beneficiaries will pay the amount of the account holder. It is also known by the name of permanent life insurance.

The fundamental advantage of whole life insurance policy is that its value rises over time. Whole Life Insurance approach methodology is simply the same as a retirement account. In this sort of policy, the policyholder needs to pay the premium up to its demise.

The most essential fascinating truth of the whole life coverage approach is that you can actually borrow money out of your account, but it is mandatory to deposit premium from time to time into your account.

Mostly, this policy gets mature when the individual scopes to the age of 100. But if the individual is still alive then the protection holder will get the advantages of the face value of their account.

Advantages of Whole Life Insurance:

- In whole life insurance coverage, you need to deposit the premium of fixed amount throughout the length of the policy, so when you will retire from a job, then it is easy for you to pay the same insurance premium. during the remaining years of the policy. Whenever holder dies, the beneficiaries will receive money. Also, individuals get the benefit of assured for rest of life.

- In this policy, participants have to receive dividends.

- Policyholder also gets the tax benefits in this policy, if the policy is canceled most of the money will be returned.

- Besides, the money that gets accumulates in your policy account is tax-free.

Different sorts of Whole Life Insurance:

- Non-Participating Whole Life Insurance

- Participating Whole Life Insurance

- Single Premium Whole Life Insurance

- Intermediate Whole Life Insurance

Participating Whole Life Insurance, the policyholder receives a sum of money by begging of your policy. On the other hand, in a nonparticipating insurance policy, you do not get the dividends for your policy. Moreover, in single premium whole life insurance, the policyholder has to pay a large sum of money in the begging of policy. The holder has to pay a large sum of money up front so this type of policy is not popular among people.

Insurance holder paid premium amount varies over time depending on the status. Survey reveals that this policy is not the good choice because many people lost their homes because of adjustable mortgages. So it is essential that before buying any type of policy you must aware of all the terms and conditions of the policy. Before investing money in any policy, it is necessary for a policyholder to estimate that it will easy for him to pay the premium of policy for the rest of life.

Index Universal Life Insurance

Index Universal Life Insurance policy, offers a choice to the policyholder to determine, what percentages of their funds that they wish to allocate to either in the fixed account or in equity-indexed portion. It gives the two options to the policyholders. The first option is that the fixed rate paid on the cash value, and another is interest rate changes depends on the movement of the index of the stock market. The value of index varies from company to company and from product to product.

These types of index universal policy give assurance of principal amount to the policyholders. In this policy, you can adjust the premium amount of your policy according to your situations. Policies give the option of a variety of well-known indexes such as S&P 500 or the NASDAQ 100.

The SSP 500 and the US Aggregate Bond Index are the common benchmarks for American stock and bond market respectively. Even some policies permit the policyholders to choose the multiple indexes to invest money. Indexed Universal Insurance Policy gives the assurance of minimum fixed interest rate and the choices of multiple indexes. A policyholder can decide the allocation of money either to fixed or indexed accounts.

Indexed universal life insurance is more volatile but it is less risky as compared to variable universal life policies because in reality no amount is invested in equity positions. The total amount of cash value policyholder is credited based on the increase in an equity index but in actually not directly invested in the stock market.

The value of the selected index firstly calculates at the start of the month, and then at the end of the month after that, there is a comparison of value from starting to end the month. If the indexes are continuously increased during the period of a month, then at the end period of a month the interest is added to the cash value of policyholder.